NEWS & INSIGHTS

Introduction

If you own or operate a business in Florida, the words “sales tax audit“ can trigger immediate stress — and for good reason. A Florida sales tax audit conducted by the Department of Revenue (FDOR) can result in significant tax assessments, penalties, and interest charges. Worse, mishandling the audit process can expose businesses to criminal investigations or even shutter operations entirely.

That’s why having a strong Florida sales tax audit defense plan isn’t optional — it’s essential. Whether you have already received a notice of audit, suspect you may be targeted, or simply want to safeguard your company in advance, understanding the audit process and preparing an effective defense strategy can make the difference between a manageable issue and a business-threatening disaster.

This Ultimate Guide to Florida sales tax audit defense will walk you through everything you need to know: what triggers an audit, how the process works, practical defense strategies, common pitfalls to avoid, and how to fight back if you disagree with the Department’s findings. Let’s get started.

What is a Florida Sales Tax Audit?

A Florida sales tax audit is a formal examination conducted by the Florida Department of Revenue to verify whether a business has properly reported and remitted the correct amount of sales tax. In Florida, businesses that sell tangible personal property, certain services, commercial rentals, or admissions must collect and pay sales tax. Failing to do so — even unintentionally — can lead to costly consequences.

During an audit, the FDOR reviews financial records, sales documentation, and tax returns to determine if there are any discrepancies or unpaid taxes. If errors or underpayments are found, the Department can assess additional tax liabilities, penalties, and interest. In severe cases, the Department may refer the case for criminal prosecution under Florida law.

It’s important to understand that a sales tax audit is not a random checkup in most cases. Businesses are typically selected for audit because of specific risk factors, patterns, or anomalies in reporting. Knowing how Florida sales tax audits work — and how to defend against them — is the first step in protecting your business from unnecessary financial and legal risk.

What Triggers a Florida Sales Tax Audit?

Most Florida businesses aren’t selected for sales tax audits at random. The Florida Department of Revenue (FDOR) relies on data analytics, tax return review processes, and industry profiling to flag potential compliance issues. Understanding the most common sales tax audit triggers is a key part of building a proactive Florida sales tax audit defense strategy.

Below are the top factors that can lead to a Florida sales tax audit:

1. Inconsistent or Incomplete Tax Returns

The FDOR uses sophisticated software to compare sales tax filings (Form DR-15) against other financial information, including:

Federal income tax returns

Corporate income tax returns (Florida Form F-1120)

Bank deposit records

Merchant processor reports (e.g., Square, Stripe, PayPal)

If your sales tax returns show significantly lower reported sales compared to these other sources, it may prompt an audit.

2. High Refund Claims

Florida businesses that request unusually large or frequent refunds of sales tax may draw scrutiny. Refunds often require supporting documentation, and if records are missing or unclear, the FDOR may launch an audit to investigate further.

3. Operating in a High-Risk Industry

Certain industries are historically associated with higher audit risk due to the nature of their operations, cash handling, or tax complexity. These include:

Restaurants and bars

Construction contractors

Gas stations and convenience stores

Retailers (especially with high inventory turnover)

Auto dealerships

E-commerce and remote sellers

Real estate rental companies

These industries often deal with exemption certificates, nontaxable sales, or transactions that are difficult to document — making them prime targets for Florida sales tax audits.

4. Nexus from Out-of-State Sales

Since the U.S. Supreme Court’s South Dakota v. Wayfair, Inc. decision in 2018, Florida has aggressively pursued economic nexus enforcement. Out-of-state businesses that sell into Florida and meet the sales threshold ($100,000 in annual sales) are required to collect and remit Florida sales tax.

Failure to register and file, even by mistake, can trigger a full audit — especially after Florida’s economic nexus law took effect in July 2021. Remote sellers should be particularly alert to this risk.

5. Random or Rotational Selection

In some cases, the FDOR selects businesses at random or as part of an industry-wide sweep. These types of audits often occur when the Department is focused on compliance in a specific sector or geographic region.

6. Competitor or Whistleblower Complaints

The Department may initiate an audit after receiving a tip from:

A former employee

A disgruntled customer

A competitor who believes you’re undercutting prices by not collecting tax

While not all tips lead to action, complaints backed by specific claims (e.g., “They don’t charge sales tax on XYZ”) are often taken seriously.

7. Prior Noncompliance or Late Filings

If your business has a history of:

Late or incomplete filings

Failure to remit collected tax

Penalty notices or past due tax balances

…you’re more likely to land back on the Department’s radar. Even a prior resolved audit doesn’t insulate you from future review.

Why Triggers Matter for Your Sales Tax Audit Defense

Knowing the trigger that led to your audit can help shape your Florida sales tax audit defense strategy. If the audit was triggered by a refund request, for example, your defense may center around validating documentation. If it was initiated due to industry profiling, your attorney may focus on ensuring the audit methodology is fair and industry-appropriate.

No matter the trigger, early recognition and response is key. The sooner you understand why the FDOR is auditing your business, the better you can prepare a strong and targeted defense.

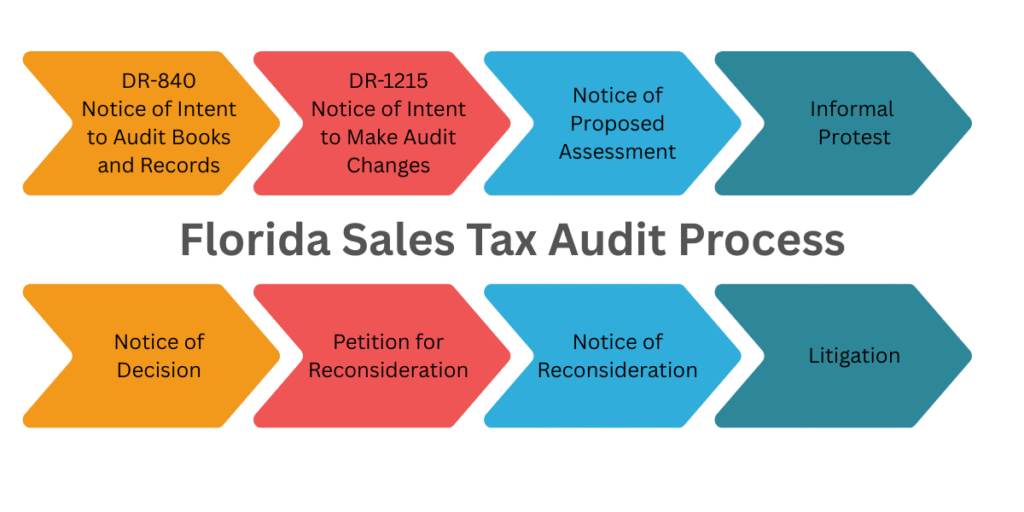

The Florida Sales Tax Audit Process: Step-by-Step

Once a Florida business is selected for a sales tax audit, the Florida Department of Revenue (FDOR) follows a structured process designed to evaluate the accuracy of the business’s sales tax reporting and compliance. For business owners, understanding this process is essential to developing an effective Florida sales tax audit defense strategy. Each phase offers both risk and opportunity — and how you respond can significantly impact the outcome.

Here’s a step-by-step overview of what to expect during a typical Florida sales tax audit:

1. Notice of Intent to Audit (Form DR-840)

The audit process begins when the FDOR issues a Form DR-840, formally titled the Notice of Intent to Audit Books and Records. This notice typically arrives by certified mail and provides:

The name of the auditor

The tax types and periods under review

A general request to schedule an opening conference

📌 Tip: The DR-840 should never be ignored. It is not simply a request — it is a legal notice that your business is now under audit. Immediate action is critical.

2. Opening Conference

During the opening conference, the auditor will explain the scope of the audit, including which tax periods are under review and what records are required. This meeting may be conducted in person, over the phone, or virtually.

The FDOR will request a broad range of documents, including:

Sales tax returns (Form DR-15)

Federal income tax returns

Bank statements

Daily sales summaries or Z-tapes

General ledger and financial statements

Exemption and resale certificates

POS (point-of-sale) system reports

This phase sets the tone for the entire audit. Having an experienced representative — ideally a tax attorney or CPA familiar with Florida sales tax audit defense — at this stage can ensure that only necessary records are disclosed, and that the Department does not overreach.

3. Information Gathering and IDRs

The auditor will issue one or more Information Document Requests (IDRs), which are formal lists of documents or explanations needed to proceed. These may ask for:

Sales invoices

Vendor purchases

Cash register tapes

Reconciliation reports

At this point, the FDOR may also inquire about internal controls, how sales tax is collected and recorded, and how exempt transactions are documented.

⚠️ Warning: Responding incompletely or inaccurately to IDRs can lead to assumptions, extrapolations, and inflated assessments.

4. Fieldwork and Analysis

Once the documentation is provided, the auditor conducts fieldwork, which may occur on-site or remotely. During this phase, the FDOR will:

Analyze sales trends

Match reported sales to bank deposits

Review exemption certificates for compliance

Select “test periods” for sampling

Conduct markup or projection analyses (especially when records are incomplete)

If documentation is lacking, the FDOR may apply estimation methods — like using average daily sales or purchase markups — to calculate unreported taxable sales.

These methods often skew against the taxpayer, especially if applied to unusual or seasonal periods. A strong Florida sales tax audit defense can involve challenging these methodologies and advocating for more representative data sets.

5. Preliminary Findings – Notice of Intent to Make Audit Changes (Form DR-1215)

Before issuing a formal assessment, the auditor will often provide preliminary findings outlining the issues discovered and the proposed tax liabilities. In Florida, preliminary findings are provided in a Notice of Intent to Make Audit Changes (Form DR-1215). This is a critical opportunity for the business or its representative to:

Correct misunderstandings

Provide missing records

Challenge sampling assumptions

Negotiate scope limitations

Early intervention at this stage can drastically reduce the final amount owed or eliminate issues entirely. Generally, the Department of Revenue provides 30 days to respond to a Notice of Intent to Make Audit Changes before moving on to issue a Notice of Proposed Assessment.

6. Notice of Proposed Assessment (NOPA)

If disputes are unresolved, the FDOR issues a Notice of Proposed Assessment (NOPA), which states:

The tax amounts owed

Applicable penalties and interest

The taxpayer’s appeal rights

You have 60 days from the date of the NOPA to file a written protest and preserve your rights to challenge the findings.

📌 Key Defense Point: If you miss this 60-day window, the assessment becomes final and collectible — and your options to fight it narrow significantly.

7. Protest, Settlement, or Litigation

If you disagree with the assessment, you can initiate a formal protest to the Department of Revenue’s Office of Appeals. This is a written legal brief explaining your position and attaching evidence.

Possible outcomes include:

Resolution at the informal level through negotiation

Referral to DOAH (Division of Administrative Hearings) for litigation

Filing a petition in circuit court, depending on the facts and strategy

An experienced Florida sales tax audit defense attorney can help evaluate which forum offers the best chance of success — and how to build your strongest case.

The Florida sales tax audit process is rigid in structure but highly flexible in outcome — especially if you engage the right professionals early. From the moment you receive a DR-840 through the issuance of a DR-1215, every step you take (or don’t take) can affect the result.

Key Sales Tax Audit Defense Strategies

Whether you’re preparing for an upcoming audit or responding to one already underway, the success of your Florida sales tax audit defense depends heavily on the steps you take before, during, and after the audit process. A passive approach almost always results in a larger assessment — often based on flawed assumptions or missing data. A proactive, informed defense can reduce your liability significantly or even eliminate it entirely.

Below are proven strategies for mounting an effective Florida sales tax audit defense:

1. Retain Experienced Florida Sales Tax Counsel Early

One of the biggest mistakes businesses make is waiting too long to involve legal or accounting professionals. By the time a Notice of Proposed Assessment (DR-1215) is issued, damage may already be done.

Your best opportunity to control the audit outcome is at the earliest stage — right after receiving the DR-840.

An experienced Florida tax attorney or CPA can:

Limit overbroad requests from the auditor

Ensure you don’t inadvertently admit liability

Guide document production to avoid red flags

Identify when criminal risks may exist

Auditors are not your adversaries — but they are trained to uncover unreported tax. You need someone in your corner who understands both the law and the Department’s tactics.

2. Organize and Preserve Strong Documentation

In every Florida sales tax audit, documentation is your most powerful weapon. The Department must rely on your records to determine whether you collected and remitted the correct amount of tax. If your records are incomplete, auditors will substitute their own assumptions — and those assumptions rarely favor the taxpayer.

Key documents to maintain and prepare include:

Florida sales tax returns (Form DR-15)

General ledger and journal entries

Daily sales summaries and Z-tapes

POS reports, receipts, and invoices

Bank statements and deposit records

Valid resale and exemption certificates

Pro tip: Keep digital backups. Auditors often request Excel versions of reports to facilitate sampling and analysis. If you only provide PDFs or incomplete exports, your data may be misinterpreted or excluded entirely.

3. Understand Florida’s Complex Taxability Rules

Florida’s sales tax laws are full of exceptions and industry-specific quirks. For example:

Commercial real property rentals are taxable; residential leases over six months are not.

Catering is taxable, but some delivery charges may be exempt.

Labor charges can be exempt or taxable, depending on whether they’re separately stated or part of a taxable service.

Failing to apply Florida’s taxability rules correctly can lead to undercollection — and therefore large audit assessments. Conversely, overcollecting tax without proper remittance can lead to criminal implications under Florida law.

A knowledgeable sales tax advisor can:

Help you identify non-taxable sales incorrectly assessed

Prove exemption with proper documentation

Draft taxability memos for recurring issues

4. Challenge the Department’s Audit Methodology

When records are incomplete or unclear, Florida auditors often resort to estimation methods, including:

Sampling: Using a small “test period” and projecting the results across multiple years.

Mark-up analysis: Estimating taxable sales based on cost of goods sold and assumed profit margins.

Bank deposit analysis: Comparing total deposits to reported sales, often failing to account for non-sales receipts (e.g., loans, owner contributions).

These methods can dramatically inflate your tax liability — particularly if the test periods are unrepresentative (e.g., holiday season) or the mark-up is based on flawed assumptions.

Push back on sampling periods and assumptions. Provide context for anomalies, and offer more representative alternative periods if available.

5. Avoid Admitting Errors Without Legal Review

Many business owners, trying to be cooperative, unintentionally admit to errors or misstatements during interviews or in email exchanges. These admissions can be used against you in final audit determinations — or worse, as the basis for criminal referral.

Always respond to auditor inquiries through your representative whenever possible. Even casual language like “I guess we forgot to charge tax on that” can cause serious problems later.

6. Negotiate Settlements and Use the Protest Process Strategically

If the Department issues a Notice of Proposed Assessment, you have 60 days to protest. During this period, you may be able to:

Submit additional documents

Negotiate a settlement or reduced assessment

Work with an independent Department reviewer

You do not have to go straight to litigation. Often, the most effective Florida sales tax audit defense happens in the protest stage — especially when you bring in a legal advocate who understands the Department’s internal resolution process.

7. Be Aware of Criminal Exposure

If the Department believes you collected sales tax but failed to remit it — or falsified records — your case may be referred for criminal investigation. This is especially true when:

The same errors occur over multiple periods

The amount exceeds $20,000

Not all audits are civil. The line between a civil and criminal sales tax investigation in Florida is thinner than most business owners realize.

Ultimately, the best Florida sales tax audit defense is preparation. If you maintain clean records, understand the state’s taxability rules, respond strategically, and get professional guidance early, you can dramatically improve your audit outcome.

Common Mistakes That Hurt Florida Sales Tax Audit Defense

Even the most well-intentioned business owners can undermine their own Florida sales tax audit defense without realizing it. Many of the largest audit assessments aren’t caused by fraud or intentional evasion — they’re the result of unforced errors, bad assumptions, or poor timing.

Avoiding the following mistakes can help protect your business during a Florida Department of Revenue audit:

1. Failing to Get Professional Help Early

Waiting until the auditor has issued findings — or worse, a Notice of Proposed Assessment — is one of the most common and damaging missteps. Many business owners try to handle the audit themselves, believing they can “explain it all.”

Once the auditor has formed an opinion, it’s difficult to change course. Bringing in a Florida tax professional early allows you to shape the narrative, control disclosures, and challenge assumptions before they become final.

2. Providing Too Much (or Too Little) Information

Some businesses hand over everything — years of bank statements, spreadsheets, internal emails — without review. Others respond too narrowly, omitting key documents and forcing the auditor to estimate.

Both extremes can backfire:

Too much information creates confusion or exposes unrelated issues.

Too little leads to adverse assumptions and inflated assessments.

The right approach? Curated, strategic disclosure, guided by someone who understands both the audit process and Florida tax law.

3. Relying on Verbal Explanations Instead of Documentation

Auditors are required to base their findings on records — not conversations. If you explain a transaction but don’t provide supporting documentation, the explanation may be disregarded.

Example: Saying “those were exempt sales” without valid resale certificates will not be enough. The burden is always on the taxpayer to prove exemptions.

Florida sales tax audit defense is document-driven. If it’s not on paper (or PDF), it didn’t happen.

4. Missing the 60-Day Protest Window

Once the Department issues a Notice of Proposed Assessment, you have 60 days to file a written protest. If you miss this deadline:

The assessment becomes final.

You lose the right to challenge it administratively.

Your only remaining option is to pay and sue for refund — often an uphill battle.

Never wait until Day 59. If you need more time, your representative can often request an extension or file a protective protest to preserve your rights.

5. Assuming the Auditor is Always Right

Auditors are professionals, but they make mistakes — especially when:

Relying on flawed sampling periods

Misclassifying nontaxable transactions

Ignoring seasonal variations in revenue

Misapplying exemption rules

Just because a number appears on a spreadsheet doesn’t mean it’s correct. A strong Florida sales tax audit defense involves reviewing every line of the Department’s work and pushing back when necessary.

6. Ignoring Criminal Warning Signs

Some business owners treat an audit like a routine review — even when serious red flags are present. If you:

Collected sales tax but didn’t remit it

Filed zero returns while operating

Altered records post-filing

…you may be facing more than just a bill. Continuing to cooperate without counsel in these cases can lead directly to criminal charges.

If you are contacted by a criminal investigator, stop talking and call a lawyer immediately.

Appealing a Florida Sales Tax Audit Assessment

If the Florida Department of Revenue has issued you a Notice of Proposed Assessment (NOPA) and you disagree with the findings, you have the legal right to challenge the assessment. But time is short — and the rules are strict. A well-executed appeal is one of the most important components of a successful Florida sales tax audit defense.

Here’s how the process works and what you need to know to preserve your rights and improve your odds.

1. Understand the 60-Day Deadline

Once the NOPA is issued, the clock starts ticking. You have 60 days from the date on the notice (not the date you receive it) to:

File a formal written protest with the Department, or

Pay the tax and later file a refund claim (not recommended unless strategically necessary)

Failure to act within the 60-day window means the assessment becomes final and enforceable. The Department may initiate collection actions, including tax warrants, liens, or bank levies.

If you’re nearing the deadline, your representative can file a protective protest to preserve your rights while you gather supporting documents or legal arguments.

2. Submit a Strong Written Protest

A protest isn’t just a letter saying “I disagree.” It should be a formal, persuasive brief that outlines:

The factual errors in the audit

The legal grounds for contesting the assessment

Supporting documentation

A clear request for relief (e.g., full or partial abatement)

A well-written protest can often lead to a resolution without litigation. The Department assigns your protest to a designated conferee, who may be more open to settlement or reconsideration than the original auditor.

Florida sales tax audit defense strategy tip: This is where you shift from damage control to active advocacy. A protest handled by experienced counsel often results in lower assessments, penalty waivers, or even full withdrawals.

3. Negotiate a Resolution with the Department

Many sales tax audit disputes are resolved through negotiation after the protest is filed. Possible outcomes include:

Reduction or removal of penalties

Adjusted tax amounts based on new documentation

Settlement agreements for partial payments

Referral to other forums for formal hearing

Having a representative who understands how the Department evaluates settlements can be the difference between an unaffordable bill and a manageable resolution.

4. Proceed to Administrative Hearing or Litigation

If a settlement cannot be reached, you can escalate the dispute to one of two forums:

A. Division of Administrative Hearings (DOAH)

DOAH proceedings are like a trial before an administrative law judge (ALJ), but without a jury. The ALJ reviews the evidence and issues a recommended order, which the Department can adopt or challenge.

DOAH is often preferred for its procedural fairness and speed. It’s also less expensive than full litigation.

B. Circuit Court

In some cases, especially those involving constitutional questions or complex procedural issues, you may choose to pursue relief through the Florida circuit courts.

Litigation is more formal and expensive than DOAH, but it may be appropriate in high-stakes cases or where DOAH jurisdiction is limited.

Not all cases belong in court. The best forum depends on your facts, industry, potential exposure, and procedural history. Your tax counsel should evaluate which path offers the best outcome.

5. Consider a Refund Suit (If You’ve Already Paid)

If you paid the tax to stop enforcement but still want to challenge it, you may be able to file a refund claim. This can be done administratively or judicially, but the burden of proof is on you, and the process is time-consuming.

Refund litigation is often harder to win, which is why it’s better — whenever possible — to protest before paying.

The Notice of Proposed Assessment may feel like a final decision, but it’s really just the beginning of your opportunity to fight back. Whether through protest, negotiation, or litigation, businesses in Florida have powerful tools to dispute unfair sales tax assessments — if they act quickly and strategically

Special Risks: When a Florida Sales Tax Audit Turns Criminal

Most Florida sales tax audits are purely civil matters — meaning they involve disputes about taxes, penalties, and interest, but not criminal charges. However, certain audits can escalate if the Florida Department of Revenue (FDOR) uncovers evidence suggesting intentional misconduct. In those cases, businesses and owners could face criminal investigation, prosecution, and severe penalties.

Understanding when an audit crosses the line into criminal territory is critical for any effective Florida sales tax audit defense.

1. When Does a Florida Sales Tax Audit Become Criminal?

A civil audit may trigger criminal investigation if the Department discovers or suspects:

Collected but unremitted sales tax (theft of state funds)

Falsified tax returns or supporting documents

Intentional underreporting of taxable sales

Repeat violations despite previous warnings or penalties

Under Florida law, specifically Section 212.15, Florida Statutes, sales tax collected from customers is held in trust for the State of Florida. Failing to remit collected tax is treated as theft — not merely a tax dispute.

If the Department believes a business owner intentionally deprived the state of tax funds, they can refer the case to the Department of Revenue’s Criminal Investigations Unit or to a state attorney’s office for prosecution.

2. There Is No Formal “Criminal Audit Notice”

Importantly, Florida does not issue a special “criminal audit form” at the beginning of an audit.

You can still receive a standard Notice of Intent to Audit (Form DR-840) regardless of whether the case is civil or later suspected of criminal issues.

Escalation to criminal investigation can happen during the audit if troubling facts emerge.

However, more commonly, someone is reported for criminal activity or a taxpayer has fallen off a payment plan of taxes already admitted to be collected and due.

This makes it even more important to conduct yourself carefully during the audit process, especially once sensitive issues are identified.

3. Warning Signs That a Criminal Investigation May Be Developing

Because there is no formal “criminal audit notice,” businesses must watch for indirect warning signs, such as:

The auditor starts asking questions about intent, knowledge, or purpose of certain actions.

Requests for sworn affidavits or recorded interviews.

Involvement of special investigators or criminal division personnel.

Extended delays after document production (indicating possible criminal review).

Requests for interviews without counsel present.

If you notice these signs, you should immediately seek legal representation with experience in Florida sales tax audit defense and criminal tax matters.

4. Potential Criminal Penalties

If criminal charges are pursued, penalties under Florida law can be severe:

| Amount of Tax Involved | Charge | Maximum Penalty |

|---|---|---|

| Less than $300 | Second-degree misdemeanor | 60 days jail, $500 fine |

| $300–$19,999 | Third-degree felony | 5 years prison, $5,000 fine |

| $20,000–$99,999 | Second-degree felony | 15 years prison, $10,000 fine |

| $100,000 or more | First-degree felony | 30 years prison, $10,000 fine |

Convictions may also result in:

Restitution orders (repayment of stolen tax)

Probation

Permanent criminal record

Revocation of business licenses

5. Critical Step: Stop Talking Without Counsel

If you believe your Florida sales tax audit could be turning criminal:

Do not continue explaining or justifying past reporting without a lawyer.

Do not guess or speculate about missing records.

Do not assume cooperation alone will prevent charges.

The right move is to respectfully decline further discussions and immediately retain experienced tax counsel.

Once a case is criminal, anything you say can — and will — be used against you.

While most Florida sales tax audits remain civil, some can quietly shift into criminal investigations if the Department of Revenue suspects theft of tax funds or deliberate fraud. Recognizing the warning signs and seeking experienced help immediately is vital to protecting your business, your reputation, and your freedom.

Industries at High Risk for Florida Sales Tax Audits

Although any business that collects or should collect Florida sales tax can be audited, certain industries consistently face higher audit risk due to the nature of their operations, the complexity of tax rules, and historical compliance problems.

Understanding if your business falls into a high-risk category is an important part of proactive Florida sales tax audit defense — and can help you prepare the documentation and strategies needed long before the Department of Revenue arrives.

Here’s a look at the industries most often targeted for Florida sales tax audits:

1. Restaurants and Bars

Restaurants and bars are among the most heavily audited businesses in Florida.

Key risk factors include:

High volume of cash transactions (even in today’s card-heavy environment)

Complex sales (e.g., alcohol taxed differently from food)

Discounts, promotions, and comps that complicate reporting

Tip pooling and service charges, which can be taxable in certain situations

Defense tip: Maintain daily Z-tapes, POS summaries, separate tracking of taxable vs. nontaxable sales (like gift card sales), and clear documentation of discounts and coupons.

2. Construction Contractors

Florida’s sales tax rules for contractors are complicated — and often misunderstood. Depending on the type of contract (lump sum vs. cost-plus), contractors may owe tax on:

Purchased materials

Fabricated goods

Real property improvements

Contractors who fail to pay tax properly or incorrectly treat labor as exempt can easily face large assessments.

Defense tip: Understand whether you are acting as a retailer or consumer of materials — and document project classifications accordingly.

3. Retail Stores

Brick-and-mortar retailers — particularly those selling tangible personal property — are frequent audit targets. Risk areas include:

Missing or invalid resale and exemption certificates

Unreported cash sales

Poor inventory control that doesn’t match sales reporting

Coupon, loyalty, and gift card complications

Defense tip: Regularly update and validate exemption certificates. Reconcile inventory with reported sales monthly to catch discrepancies early.

4. Automobile Dealerships

Car dealers deal with large, high-value transactions involving both taxable and exempt sales (e.g., sales to government agencies, trade-ins, repossessions). Common issues include:

Miscalculation of taxable selling price

Failure to collect “dealer fees” properly

Errors in trade-in allowances

Defense tip: Ensure that all supporting paperwork (bill of sale, finance agreements, trade-in valuations) is preserved and reconciled with tax reporting.

5. E-Commerce and Remote Sellers

Since the enactment of Florida’s economic nexus rules (effective July 1, 2021), remote sellers who:

Make $100,000+ in annual Florida sales, or

Use online marketplaces to reach Florida customers

are required to register, collect, and remit Florida sales tax.

Many remote sellers are unaware of these obligations — or mistakenly believe marketplace facilitators have relieved them of all duties.

Defense tip: Confirm whether your sales meet the Florida economic nexus threshold. If you use multiple sales platforms, ensure each platform’s tax collection practices are correct and properly documented.

6. Commercial Real Estate and Leasing Businesses

Florida is one of the few states that taxes commercial real property rentals. Businesses leasing office space, retail units, or warehouses must collect and remit sales tax on rental payments unless a valid exemption applies.

Common mistakes include:

Failing to tax security deposits later applied to rent

Misapplying exemptions for short-term leases

Underreporting taxable leasehold improvements

Defense tip: Review all leases for taxable elements and ensure your invoicing system properly applies sales tax to rent charges.

7. Nail Salons, Barbers, Hair Salons, and Adult Entertainment Clubs

Why Industry Targeting Matters for Your Defense Strategy

The Florida Department of Revenue has extensive audit experience in these industries. Auditors often arrive with preconceived expectations about what errors they expect to find.

Knowing your industry’s common pitfalls allows you to:

Assemble stronger supporting documentation in advance

Tailor your Florida sales tax audit defense to the Department’s likely focus areas

Challenge invalid assumptions based on real-world operating differences

Proactive defense beats reactive crisis management every time — especially in high-risk sectors.

Conclusion: Protecting Your Business with Effective Florida Sales Tax Audit Defense

A Florida sales tax audit can be a disruptive and stressful experience — but it doesn’t have to be a disaster. With the right preparation, documentation, representation, and strategy, you can control the audit process, minimize exposure, and, in many cases, reduce or eliminate proposed assessments altogether.

The key to effective Florida sales tax audit defense is recognizing that an audit is a legal and financial proceeding — not just an informal review. Auditors are trained to find mistakes. Without strong records, strategic responses, and skilled advocacy, small errors can snowball into large assessments, penalties, and even criminal investigations.

Businesses that succeed in defending Florida sales tax audits:

Respond immediately and appropriately to audit notices

Organize and protect key documentation

Understand Florida’s specific sales tax laws and industry risks

Challenge flawed audit methodologies and incorrect assumptions

Engage experienced professionals early in the process

Remain proactive rather than reactive at every stage

Whether you’re a restaurant, retailer, contractor, car dealership, or e-commerce seller, Florida’s sales tax rules are complex — and enforcement is aggressive. Protecting your business requires more than good intentions; it demands informed action.

If your business has been contacted by the Florida Department of Revenue, or if you simply want to be prepared for a possible future audit, now is the time to invest in your Florida sales tax audit defense strategy. The costs of inaction can be overwhelming — but with the right help, your business can emerge stronger, smarter, and fully compliant.

Don’t wait until it’s too late.

If you need experienced Florida sales tax audit defense, contact a qualified tax professional today.

🧠 Florida Sales Tax Audit FAQ: Everything Business Owners Ask

What is a Florida sales tax audit?

A Florida sales tax audit is an official review by the Florida Department of Revenue (FDOR) to determine whether a business has properly collected and remitted sales tax. The Department examines sales tax returns, financial records, and exemption documentation.

How do I know if I’m being audited in Florida?

You will receive a Form DR-840, called the Notice of Intent to Audit Books and Records. This is the formal notification that your business is under audit by the Florida Department of Revenue.

What triggers a Florida sales tax audit?

Florida sales tax audits are usually triggered by:

Inconsistencies between sales tax returns and income tax returns

High or repeated sales tax refund claims

Whistleblower complaints or competitor tips

Operating in a “high-risk” industry like restaurants or salons

Use of resale certificates without adequate support

Nexus from remote sales into Florida

Past due returns or noncompliance history

What documents are required for a Florida sales tax audit?

Commonly requested records include:

Florida sales tax returns (DR-15)

Federal returns (e.g., IRS Form 1120 or Schedule C)

POS system reports

Z-tapes and sales summaries

Bank statements and deposit records

Exemption and resale certificates

Purchase invoices and inventory records

Can the Florida Department of Revenue audit a closed business?

Yes. The FDOR can audit a business even after it closes, especially if it believes that sales tax was collected but not remitted, or if there is a history of noncompliance. The statute of limitations is typically 3 years, but longer if fraud is suspected.

How long does a Florida sales tax audit take?

The timeline varies by complexity, but most audits last 3 to 9 months. Factors include the business size, record quality, and whether the Department uses estimation methods or test periods.

What is a DR-1215 in a Florida sales tax audit?

The DR-1215, or Notice of Intent to Make Audit Changes, is a preliminary audit report that lists proposed findings. It gives taxpayers a chance to respond before a final assessment is issued.

What is a Notice of Proposed Assessment (NOPA)?

The NOPA is a formal notice that states the amount of sales tax, penalties, and interest assessed by the FDOR. You have 60 days to protest the NOPA before it becomes final.

How do I protest a Florida sales tax audit?

You must submit a written protest within 60 days of receiving the NOPA. The protest should explain the errors, legal arguments, and include documentation. If unresolved, the case may go to DOAH or circuit court.

What happens if I miss the 60-day protest deadline?

If you miss the deadline, the audit becomes final and enforceable. You lose the right to protest administratively and may face collection actions, liens, or garnishment.

Can a Florida sales tax audit become criminal?

Yes. If you collected sales tax and didn’t remit it, altered records, or showed intent to defraud, the Department can refer your case for criminal investigation. Penalties range from misdemeanors to first-degree felonies depending on the tax amount involved.

What industries are most likely to be audited in Florida?

The Florida Department of Revenue frequently audits:

Restaurants and bars

Construction contractors

Auto dealerships

Nail and hair salons

E-commerce and remote sellers

Adult entertainment venues

Commercial landlords

What is a “test period” in a sales tax audit?

A “test period” is a small sample of time used by the FDOR to estimate taxable sales for a larger audit period. The Department may apply mark-up analysis, bank deposit reviews, or projections based on this sample.

What is a common mistake in Florida sales tax audits?

One of the biggest mistakes is providing too much or too little documentation. Too much can open new issues; too little leads to assumptions. Another mistake is admitting errors casually in email or interviews without legal review.

Should I hire a lawyer for a Florida sales tax audit?

Yes. An experienced Florida sales tax attorney can:

Limit overbroad document requests

Protect against criminal exposure

Respond to IDRs

Protest the audit

Negotiate settlements

Represent you before DOAH or in court

Can I settle a Florida sales tax audit before litigation?

Yes. Many audits are resolved at the protest stage or through negotiation with the Department’s conferee. Settlements can reduce penalties, adjust taxable amounts, or allow installment payment plans.

What is the statute of limitations for a Florida sales tax audit?

Typically, Florida has 3 years from the date the return was filed to initiate an audit. However, if returns were never filed, fraudulent, or grossly inaccurate, the statute can be extended indefinitely.

What if I used a resale certificate but consumed the items?

If you purchased goods tax-free using a resale certificate but used them in your business (rather than reselling them), you may owe Florida use tax on the cost of those items.

Do I owe Florida sales tax on commercial rent?

Yes. Florida is one of the only states that imposes sales tax on commercial real estate rent. If you sublease space to others (e.g., booth rentals), you may be required to collect and remit sales tax on those amounts as well.

Can I file a refund claim after an audit?

Yes, but only if you first pay the tax and then file a formal refund claim. Refund litigation is harder to win than protesting during the audit process, so it’s best to challenge assessments before they become final.

© 2025 Jeanette Moffa. All Rights Reserved.

Additional Articles by the SALTy Orange at Moffa Tax Law:

Florida Repeals Sales Tax on Commercial Rent — Will DeSantis Sign the Landmark 2025 Tax Cut?

NEWS & INSIGHTS Florida Repeals Sales Tax on Commercial Rent — Will DeSantis Sign the Landmark 2025 Tax Cut? …

NEWS & INSIGHTS Is Bottled Coffee Subject to Florida Sales Tax? The Answer May Surprise You Is Bottled Coffee Subject…

Inside the ABA SALT Committee Meeting: What Tax Professionals Need to Know About the Annual May Conference in D.C.

NEWS & INSIGHTS Inside the ABA SALT Committee Meeting: What Tax Professionals Need to Know About the Annual May Conference…

Jeanette Moffa, Esq.

(954) 800-4138

JeanetteMoffa@MoffaTaxLaw.com

Jeanette Moffa is a Partner in the Fort Lauderdale office of Moffa, Sutton, & Donnini. She focuses her practice in Florida state and local tax. Jeanette provides SALT planning and consulting as part of her practice, addressing issues such as nexus and taxability, including exemptions, inclusions, and exclusions of transactions from the tax base. In addition, she handles tax controversy, working with state and local agencies in resolution of assessment and refund cases. She also litigates state and local tax and administrative law issues.