On October 2nd, 2024, the Florida Department of Revenue issued Order of Emergency Waiver/Deviation (ORDER) #24-002 (Sales and Use Tax and Related Taxes). Meanwhile, on October 11, 2024, the IRS announced an extension until May 1, 2025, to file various federal individual and business tax returns and make payments.

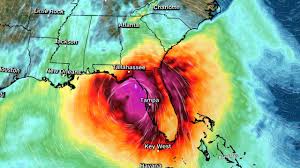

These orders from the Florida Department of Revenue and IRS are in response to back-to-back devastating storms that hit the state. Hurricane Helene hit Florida on September 26, causing substantial damage to the west coast of the state especially. Before the debris could even be cleared from affected areas, Hurricane Milton made landfall on October 9th. While the storm primarily hit the west coast, Hurricane Milton especially was filled with tornadoes that affected Floridians across the state.

Jeanette Moffa, Esq.

Phone: (954) 800-4138

Email: JeanetteMoffa@MoffaTaxLaw.com

Jeanette Moffa is a Partner in the Fort Lauderdale office of Moffa, Sutton, & Donnini. She focuses her practice in Florida state and local tax. Jeanette provides SALT planning and consulting as part of her practice, addressing issues such as nexus and taxability, including exemptions, inclusions, and exclusions of transactions from the tax base. In addition, she handles tax controversy, working with state and local agencies in resolution of assessment and refund cases. She also litigates state and local tax and administrative law issues.