The SALTy air around Margaritaville this weekend may have been provided by the beautiful Hollywood Beach, but the SALT you tasted indoors came from the Florida State Tax Division. Well, at least partially. We won’t count the rims of the green drinks found all over the resort. At the State Tax Division Meeting, some SALTy feelings were expressed about the Florida Department of Revenue’s recent audit and litigation strategies.

Florida Sales Tax Audits Using 1099-Ks

Increasingly, audits are producing inaccurate assessments by relying on third party records. While third-party records in sales tax audits is old news, what is new is that Florida is increasingly using automated and formulaic audits outside of industries whose sales are identifiable through government licensing records, such as convenience stores and automobile dealers. Florida Sales Tax Audits using 1099-Ks have seemingly been issued as fast as the Florida Department of Revenue can print them. The Florida Dept. of Revenue – 1099-K Reporting Requirements obligate credit card companies to provide the Florida Department of Revenue with reports detailing every dollar charged on a credit card by a business. There is no reduction provided in these audits for gratuities and sales taxes that are also charged on credit cards. Imagine the overestimation of tax due on Florida sales tax audits of restaurants!

Florida Tax Litigation

Meanwhile, on the other hand, Florida is taking increasingly aggressive positions in litigation. Even after an already erroneous audit is completed, the Florida Department of Revenue continues to defend positions that are inconsistent with taxpayer records, Florida Statutes, and the Florida Administrative Code. There are currently several Florida corporate income tax cases in the Leon County Circuit Court in which the Department is supporting positions taken by auditors despite the fact that they directly conflict with Florida law. Florida tax litigators are left with no option but to defend companies such as Apple, Microsoft, and others against large assessments.

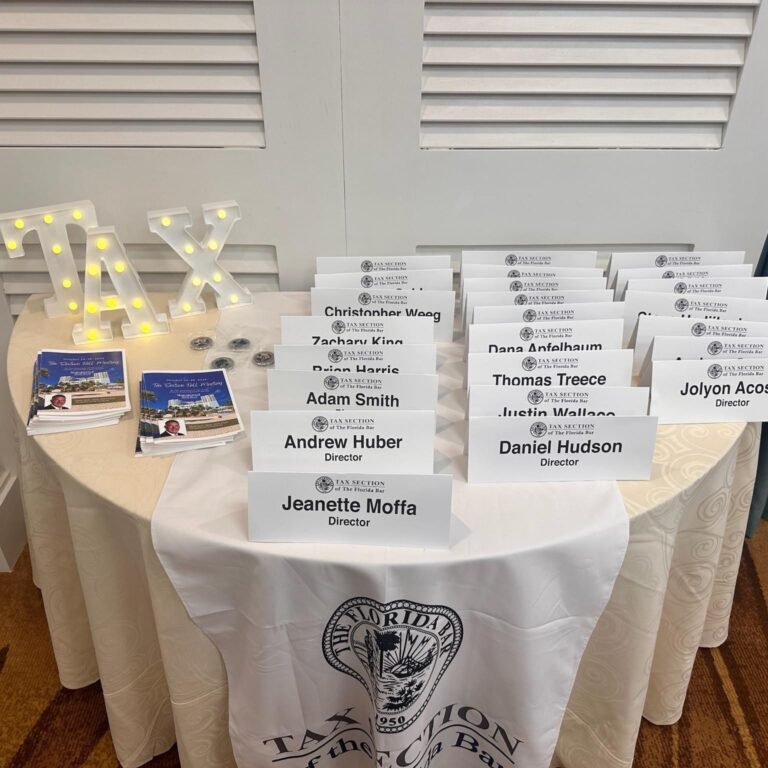

Fortunately, all the SALT in the word couldn’t touch the sweet memories shared by the Florida tax lawyers in attendance! Thanks to the wonderful Mark Scott for planning a fun-packed Florida Bar Tax Section Fall Meeting! The Director’s Meeting tackled important administrative and planning issues for the section. The incredible Chair’s Reception overlooking the ocean gave old friends time to catch up and new members an opportunity to join in on the fun! Between amazing dinners at JWB Prime Steak and Seafood and GG’s Waterfront, we are also all quite full. Scroll below for more photos from the meeting. Until the next time…

“Wastin’ away again in Margaritaville

Searchin’ for my long lost shaker of salt

Salt, salt, salt”

Jeanette Moffa, Esq.

Phone: (954) 800-4138

Email: JeanetteMoffa@MoffaTaxLaw.com

Jeanette Moffa is a Partner in the Fort Lauderdale office of Moffa, Sutton, & Donnini. She focuses her practice in Florida state and local tax. Jeanette provides SALT planning and consulting as part of her practice, addressing issues such as nexus and taxability, including exemptions, inclusions, and exclusions of transactions from the tax base. In addition, she handles tax controversy, working with state and local agencies in resolution of assessment and refund cases. She also litigates state and local tax and administrative law issues.